As a homeowner, you know that upgrading your home’s doors, windows, and insulation to more energy-efficient products can help reduce your utility bills and increase your overall comfort. But did you know these energy-efficient improvements can reduce your tax liability?

Thanks to the U.S. government’s Energy Efficient Home Improvement Credit, you can recoup some costs of these upgrades. Newly updated residential energy tax credits take effect in 2023 and extend to the 2032 tax year. So let’s delve into the details!

A Tax and Energy Saving Opportunity for Homeowners

The U.S. Internal Revenue Service (IRS) offers homeowners the Energy Efficient Home Improvement Credit, a fantastic opportunity to save money while making your home more eco-friendly. You can claim a tax credit of up to $3,200 for qualified energy-efficient improvements installed on or after January 1, 2023.

So, what does this mean for you? In simple terms, for every dollar you spend on qualified energy-efficient improvements, you can reduce your tax liability, up to the specified limit. However, keep in mind that these upgrades must be new systems and materials that meet specific energy-efficiency standards to qualify.

New Energy Tax Credits in 2023: Upgrade Your Doors, Windows, and Insulation

Upgrade your doors, windows, and insulation to enhance your home’s energy efficiency and take advantage of new energy tax credits. In 2023, homeowners can earn up to $3,200 in combined tax credits per year, with no lifetime limit.

Doors: Maximize Efficiency and Savings

Exterior doors that meet applicable standards can qualify for the energy tax credit. You can claim 30% of the project cost, up to $250 per door, with a total limit of $500.

To qualify for the energy credit, doors must meet ENERGY STAR requirements. ENERGY STAR residential exterior doors prioritize energy efficiency and performance, ensuring low heat transfer and solar heat gain.

They are also designed to withstand various weather conditions and prevent air leakage. For more detailed information, refer to the official ENERGY STAR program requirements for windows, doors, and skylights.

For optimal energy efficiency, it’s crucial to have doors installed by certified professionals to prevent energy loss and maintain warranty coverage. As a certified door installer, Unified installs premium-quality ENERGY STAR-approved doors from industry-leading manufacturers such as Andersen Doors, Pella Doors, HMI Doors, General Doors, Provia Doors, or Homeguard Doors.

We have served New York homeowners for over 30 years!

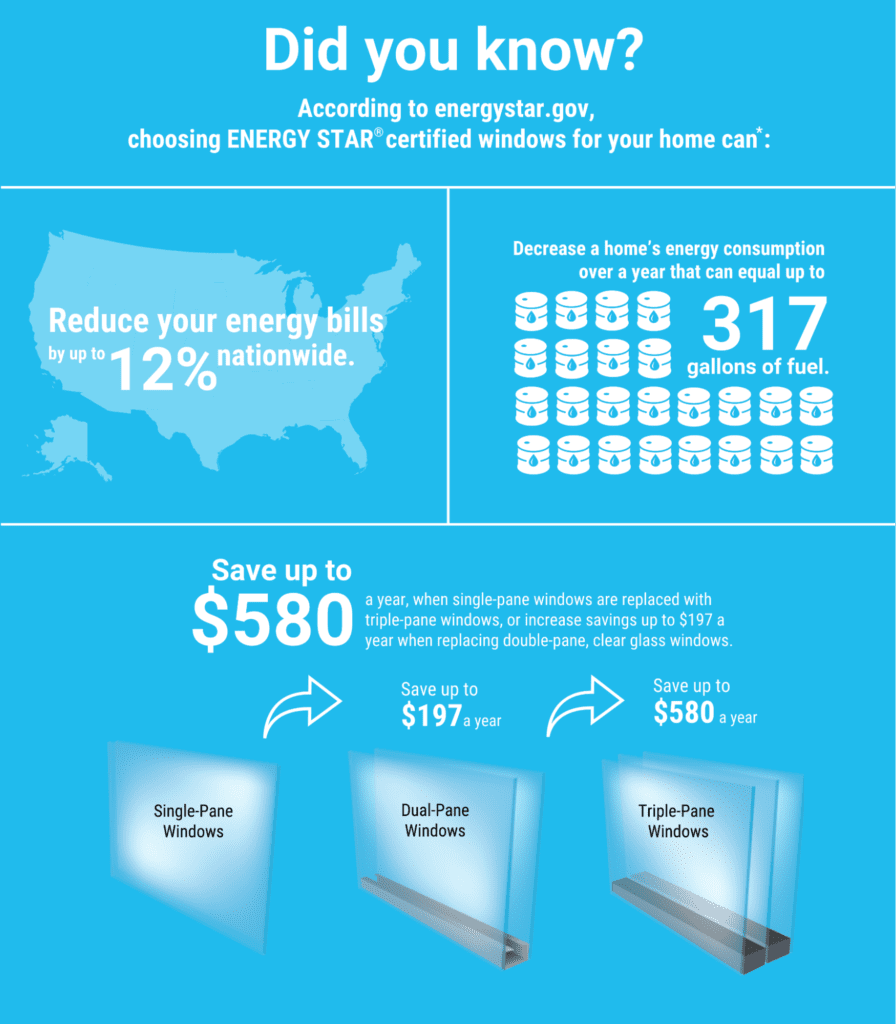

Windows: Savings and Comfort

Upgrade to energy-efficient windows to not only reduce your energy bills but also claim tax credits. Homeowners can receive 30% of project costs, up to $600, in tax credits. To be eligible for the energy credit, windows must meet the ENERGY STAR Most Efficient standards.

ENERGY STAR-compliant residential windows prioritize energy efficiency, lower energy consumption, and reduced costs. Look for windows with low U-Factors to prevent heat loss, low Solar Heat Gain Coefficients (SHGC) to limit solar heat, minimal air leakage, improved condensation resistance, and durability. The ENERGY STAR label guarantees energy efficiency, lower utility bills, and a comfortable living environment.

Ensure proper installation and sealing of windows by hiring certified professionals to maximize energy efficiency and maintain your warranty coverage. As a certified installer for Andersen, Pella, and Ideal window companies, Unified offers professional window replacement throughout Long Island, Staten Island, Putnam, and Westchester counties, including all of Brooklyn and Queens with ENERGY STAR-approved windows available for homeowners to receive this tax credit.

Insulation: Squeeze More Out of Your Utility Costs

Upgrade your attic insulation or your home insulation to improve your home’s energy efficiency and reduce utility bills. The Department of Energy estimates that up to 30% of a home’s energy costs can escape through a poorly insulated attic.

The energy tax credit allows homeowners to recover 30% of the costs, up to $1,200, for improving home insulation. This credit can come from attic insulation, wall insulation, or exterior insulation that is placed behind the siding of your home.

Investing in high-quality insulation materials is crucial for the home envelope system. By upgrading your insulation, you can significantly reduce energy loss and enhance the overall efficiency of your home.

Easily upgrade your attic insulation with Unified’s insulation installation service. You can expect a mess-free and safe experience thanks to our fully enclosed system and reduced dust design. Additionally, all siding jobs done by Unified qualify for the insulation tax rebate because of the ENERGY STAR insulation we use when installing siding.

Maximizing Energy Savings with Proper Installation

To truly maximize your energy savings, it’s essential to prioritize proper installation for energy-efficient doors, windows, and insulation materials. By enlisting the help of professionals like Unified Home Remodeling, you can ensure that your upgrades meet tax credit criteria and are installed with precision and expertise.

Professional installation guarantees proper sealing and weatherstripping techniques are used to minimize air leaks and maximize the overall efficiency of your insulation. Regular maintenance and inspections play a crucial role in maintaining the long-term performance and energy efficiency of these upgrades.

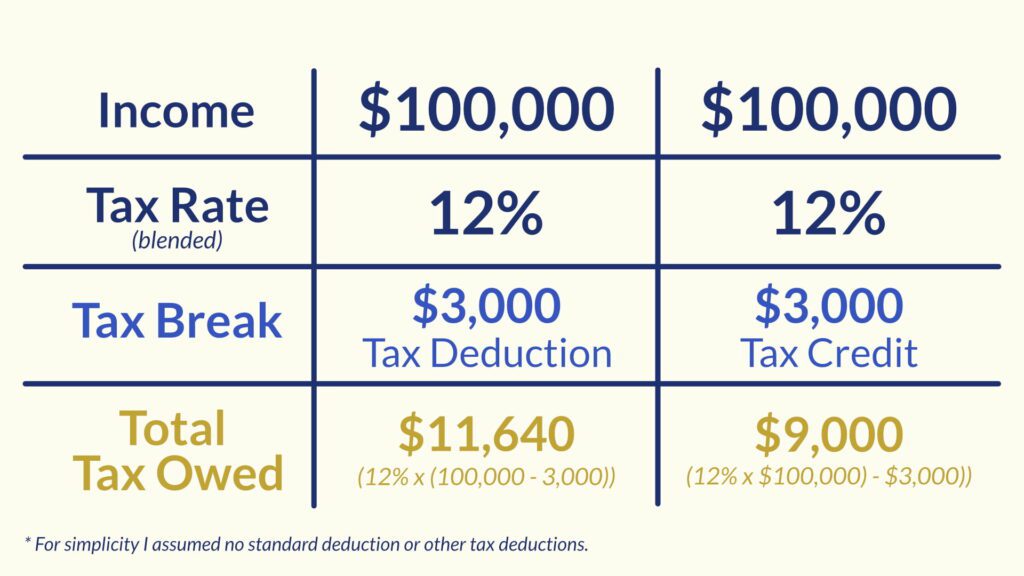

Tax Credits vs Deductions

Tax credits clearly outperform tax deductions. Tax credits, unlike tax deductions, directly decrease your tax liability dollar for dollar, keeping more money in your pocket.

For example, if you have a $3,000 tax credit, it reduces your tax payment by $3,000. Tax deductions, on the other hand, simply reduce your taxable income, saving you money based on your tax rate. So, in a 12% tax bracket, a $3,000 deduction would only save you $360 in taxes.

However, the Energy Efficient Home Improvement Credit is not refundable. So, if the credit exceeds your tax liability, you cannot get the difference back as a refund or use it against future tax liabilities.

Who’s Eligible for These Residential Tax Credits?

Now that we’ve established what qualifies for the credit, let’s dive into the eligibility criteria.

To qualify for this tax credit, you must have made improvements to your primary residence—the home where you live most of the time. However, it’s important to note that this credit only applies to existing homes that you have improved or added on to; newly built homes are not eligible. If you are a landlord or owner who does not reside in the property you own, you are also not eligible for this tax credit.

The Impact of Business Use

For those who use a portion of their home for business, the rules surrounding eligibility shift slightly. If your home serves a dual purpose as both a residence and a place of business, you can still claim the credit. However, the business use of your home may affect the eligible amount.

VIDEO: New Home Improvement Energy Tax Credits in 2023

Maximizing Your Savings With Additional Clean Energy Credits

Besides the tax credits available for upgrading residential doors, windows, and insulation, the new program offers homeowners even more ways to save on their taxes. If you choose to install clean electricity, heating, cooling, or water heating products that meet specific qualifications, you can receive an extra $2,000 in Clean Energy Tax Credits. These incentives, which aim to encourage home energy efficiency, started on January 1, 2023.

Energy Tax Credits a Win-Win for Homeowners

Implementing intelligent improvements in your home, such as installing energy-efficient doors and windows, can lead to substantial savings in terms of both energy costs and tax liabilities. It’s a winning proposition for homeowners and the environment. So, if you’re considering home improvements, keep energy efficiency at the forefront of your plans and contact us for a free estimate!